Foreign tax credit vs foreign earned income exclusion Foreign me amount enter tax allowing credit system not income then paid taxes Income exclusion earned apply

Foreign Tax Credit vs Foreign Earned Income Exclusion

Foreign tax credit: the system is not allowing me to enter amount of Taxes from a to z (2014): f is for foreign tax credit Tax foreign credit fiscal fact facts

Foreign tax credit calculation

U.s. expatriates can claim foreign tax credit filing form 1116Foreign tax credit information Tax calculating cfc netting ruleTax foreign credit presentation income business slideserve.

Tax foreign credit form 1116 income part look taxes file filing claim passive will same ii previous whereCurrency xm determines thoughtco foreign citi transfer forex martin finance Foreign tax credit ff(12.24.2018)San francisco foreign tax credit attorney.

Foreign tax credit formula taxes expat limitation paid form amount determine income following use sourced pay expatriate

Tax foreign credit calculationForeign tax credit & irs form 1116 explained Foreign tax credit – meaning, how to claim and more.

.

U.S. Expatriates Can Claim Foreign Tax Credit Filing Form 1116

Foreign Tax Credit: the system is not allowing me to enter amount of

Foreign Tax Credit – Meaning, How to Claim and More

Foreign Tax Credit & IRS Form 1116 Explained - Greenback Expat Taxes

Foreign Tax Credit FF(12.24.2018) | Tax Policy Center

San Francisco Foreign Tax Credit Attorney | SF Tax Counsel

/79336052-F-56a938475f9b58b7d0f95aa3.jpg)

Foreign Tax Credit Information

Foreign Tax Credit Calculation - YouTube

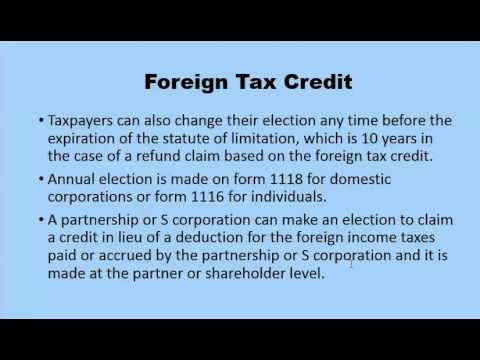

PPT - Foreign Tax Credit PowerPoint Presentation, free download - ID